They’re not redundant, though these dispute resolution platforms work best in tandem with each other. RDR would come in at the last moment to prevent a chargeback if CDRN and Order Insight had both been attempted.Īs we can see, these platforms focus on the same topic (Visa dispute prevention), but each performs a different function. It then lets merchants refund transactions before chargebacks are filed. Rather than progressing to a chargeback, the tool picks up on the pending dispute and notifies merchants before it’s too late. Benefits of RDR:Īlert merchants about pending chargebacksĬDRN detects disputes initiated by participating issuers, then works with these banks as an intermediary in the dispute process. Even if you’re already in violation of Visa’s chargeback thresholds, RDR will let you get your chargeback situation under control in a very short period of time. In this way, RDR is a great innovation, particularly if you’re concerned about potentially exceeding Visa’s allowable chargeback limit. This will make it easier to avoid breaching Visa chargeback thresholds.

Using these rules, RDR can automatically refund the transaction on your behalf, letting you avoid a chargeback.

You won’t have to touch them again unless you decide they need an adjustment. Another benefit of RDR is the near-touchless experience you can effectively "set and forget" these rules. You can create that rule and let the system automatically carry out that function.

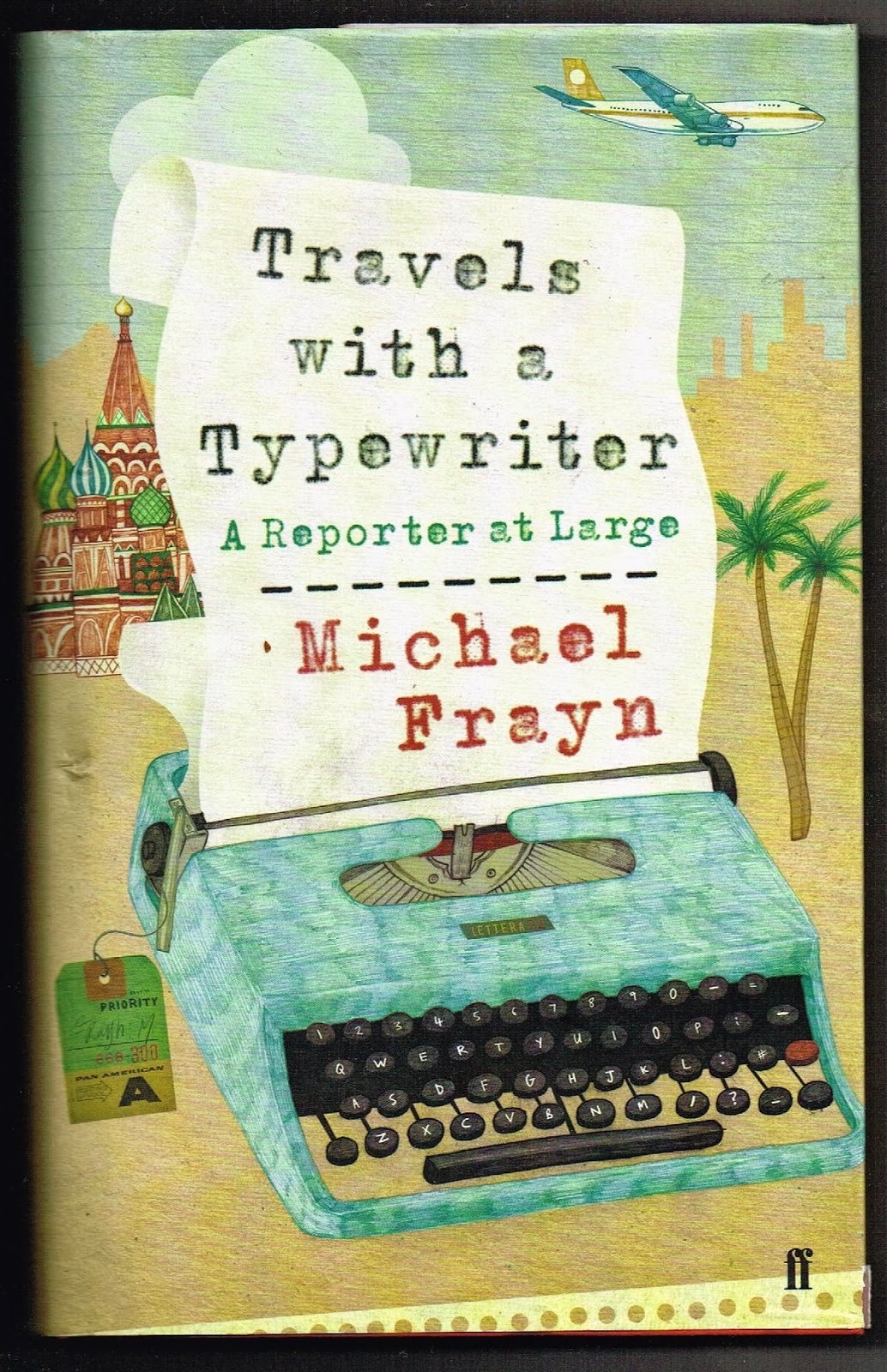

#Rapid 1keyboard lettera code

To illustrate, let's say you want to automatically credit any dispute for transactions under $10 in a certain currency code (like US Dollars). You can base them on a variety of factors, including: The rules you use to determine which disputes to refund are highly customizable. It allows issuers and acquirers to resolve disputes automatically which, in turn, keeps merchant chargeback rates low and customer satisfaction high. RDR is an improved chargeback prevention tool available through Visa systems. Their goal is to provide banks, merchants, and consumers with more comprehensive resolution methods. Since Visa’s acquisition of Verifi in 2019, Visa has spent some time overhauling its available dispute resolution platforms. The goal is to make it easier for banks to serve their clients in a quick, effective manner by automatically resolving disputes and issuing refunds according to preset rules. Rapid Dispute Resolution is a platform intended to help merchants and issuers enhance the customer experience, reduce disputes, and improve operations.

RDR allows merchants to create rules and set parameters that dictate which disputes they’d like to automatically accept and provide funds back to the cardholder, thereby preventing a chargeback for these transactions at the pre-dispute stage. Rapid Dispute Resolution (RDR) is a merchant dispute product from Verifi.

0 kommentar(er)

0 kommentar(er)